Market Volatility Could Make Roth IRA Conversion Appealing

Posted by cskadmin on January 4, 2012

Prolonged market volatility has left many investors, especially those investing for retirement, searching for strategies to cope with the situation. If you have a traditional IRA, you may want to consider converting to a Roth IRA.

As a volatile stock market continues its ups and downs, many investors facing losses are searching for strategies to help them cope with the situation. Retirement investors may want to examine converting a traditional IRA to Roth IRA, with the understanding that the conversion can be reversed if needed.

Why Now

Thanks to legislation that took effect in 2010, investors at any level of income can convert a traditional IRA to a Roth IRA. A choppy market can be an excellent time for those considering a conversion to take the plunge. Here are a few reasons why it could make sense.

- Smaller balance = small tax bite: A conversion triggers a tax bill on the amount of money that is converted, so a smaller account balance results in a smaller tax bite.

- Hedge against future tax rate increases: Many observers believe that federal taxes are likely to increase in the years ahead as the federal government grapples with budget problems. Currently, qualified withdrawals from Roth IRAs after age 59½ are tax free, which presents an important benefit for retirement investors.1

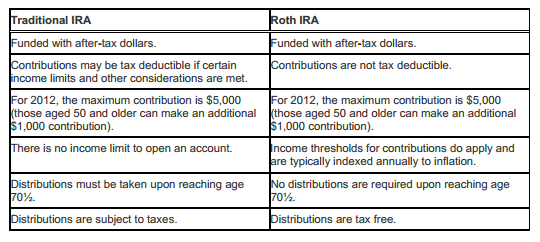

Before deciding whether a conversion makes sense for you, make sure you understand the differences between a traditional IRA and a Roth IRA. The table below includes a summary of some of the key differences. You can learn more details by referencing IRS Publication 590.

If you are considering a conversion, be sure to consult a tax professional to help you calculate the corresponding tax bill. Financial advisors usually recommend that taxes associated with a Roth IRA conversion be paid from assets outside of the Roth IRA account so as not to disrupt retirement savings.

You Can Change Your Mind

If you convert from a traditional IRA to a Roth IRA and you subsequently change your mind, there is a redo known as recharacterization. In effect, recharacterization is reversing the conversion and moving the assets back to a traditional IRA. Your financial institution can handle this transaction for you, and you are required to file an amended tax return. There are several reasons why investors may want to consider a recharacterization:

- The conversion from a traditional IRA to Roth IRA increases your marginal tax rate. (Consulting a tax advisor in advance could potentially help you avoid this situation.)

- You do not have enough cash on hand to pay the taxes.

- Note that these reasons are not specified by the IRS. According to current tax rules, you do not need to present a reason for recharacterizing.

Recharacterization needs to be complete by the last date when federal taxes, including extensions, are due. This date is usually in mid-October for the prior tax year. (For example, a Roth IRA conversion for the 2011 tax year needs to be recharacterized and an amended tax return filed by mid-October 2012.)

Source/Disclaimer:

1 Unless certain criteria are met, Roth IRA owners must be 59½ or older and have held the IRA for five

years before tax-free withdrawals are permitted.

January 2011 — This column is provided through the Financial Planning Association, the membership organization for the financial planning community, and is brought to you by Capital Strategies, Inc., a local member of FPA.

Required Attribution

Because of the possibility of human or mechanical error by McGraw-Hill Financial Communications or its sources, neither McGraw-Hill Financial Communications nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall McGraw-Hill Financial Communications be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2011 McGraw-Hill Financial Communications. All rights reserved.