Target-Date Funds: Are They Right for You?

Posted by Richard on May 15, 2013

Target-date funds provide investors with the ability to simplify their financial and investment lives.1 With target-date funds, your portfolio’s asset allocation is automatically rebalanced on your behalf over the years by professional investment managers, generally growing more conservative as the identified target date approaches.

Unlike lifestyle funds, target-date funds do not require investors to reassess their priorities and transfer money to a different fund as goals approach and priorities change. Generally speaking, the name of each target-date fund includes a specific year, such as “2030” or “2045.” All you need to do is choose a fund named for the year closest to the year of your projected retirement. From that point on, professional investment managers make all the investment decisions.

Understanding the Investment Strategy

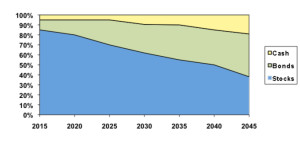

Target-date investments follow what is known as a “glide path.” The glide path maps out the investment’s asset allocation over time — the way it is divided between the principal asset classes of stocks, bonds, and cash. How your assets are allocated among these investments is a major factor in determining portfolio volatility and risk.2 As you approach retirement, a target-date investment typically reduces its holdings of stocks, while increasing its exposure to less risky bonds and cash. Target-date investments provide investors with instant diversification into different asset classes.2

Target-Date Glide Path Hypothetical Chart3

The illustration above shows you the glide path of a hypothetical 2045 target-date investment. Note how it begins investing primarily in stocks, then, over time, gradually decreases its stock component and increases its bond and cash components.

A target-date investment’s goal is to make the investing process simple. This “set it and forget it” style also makes investors less likely to allow short-term market fluctuations to adversely affect their investment decisions.

A “New Generation” of Target-Date Investments

The principal value of many target-date investments cannot be guaranteed at any time, including the target date, and may decline at any time. However, there are newer models that offer a way to protect all or some of your portfolio from market declines. These newer options are often tied to a feature that offers a lifetime income guarantee upon retirement.

Target-date options may be ideal investments for those participants who have a long time horizon and for those who don’t feel comfortable investing on their own. Be sure to review the glide paths of the target-date investments offered through your plan. If you have any questions, ask your plan administrator or financial professional.

Source/Disclaimer:

1The principal value of target-date funds is not guaranteed at any time, and you may experience losses, including losses near, at, or after the target date, which is the approximate date when investors reach age 65. The funds emphasize potential capital appreciation during the early phases of retirement asset accumulation, balance the need for appreciation with the need for income as retirement approaches, and focus more on income and principal stability during retirement. There is no guarantee that the funds will provide adequate income at and through your retirement.

Target-date funds invest in a broad range of underlying mutual funds that include stocks and bonds and are subject to the risks of different areas of the market. Target-date funds maintain a substantial allocation to stocks both prior to and after the target date, which can result in greater volatility. The more a target-date fund allocates to stock funds, the greater the expected risk. For further details on the risks associated with investment in a target-date fund, please refer to the fund’s prospectus.

2Asset allocation and diversification do not ensure a profit or protect against a loss.

3Source: S&P Capital IQ Financial Communications. Example is hypothetical and does not represent any specific target-date investment.

Required Attribution

Because of the possibility of human or mechanical error by S&P Capital IQ Financial Communications or its sources, neither S&P Capital IQ Financial Communications nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall S&P Capital IQ Financial Communications be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2013 S&P Capital IQ Financial Communications. All rights reserved.