Strategies for Smart Retirement Planning

Posted by cskadmin on January 11, 2012

Some factors that influence your retirement savings results, such as the types of investments available to you through your plan and the performance of the financial markets, can’t always be controlled. But there are some factors you can influence that can help keep your portfolio on track.

A study conducted by the Employee Benefit Research Institute estimated that the average American worker will face a retirement savings shortfall of more than $47,000.1 How can you avoid a similar fate?

Some factors that influence your retirement savings results, such as the types of investments available to you through your plan and the performance of the financial markets, can’t always be controlled. But there are some factors you can influence that can help keep your portfolio on track.

Step 1: Stay invested.

It’s not easy to see your account value decrease after a decline in the stock market, particularly after a steep, sudden drop of 10% or more. But one of the dangers of cashing out is missing a potential market rebound. Trying to “time” the market is a strategy even the most-seasoned financial professionals have difficulty mastering. It can also lead investors into the trap of “chasing gains”; that is, moving your money from one investment that’s lagging into another one that’s currently achieving better performance.

Step 2: Regularly monitor your investment mix.

One of the benefits of a diversified portfolio is balance. If one type of investment is experiencing losses, another type may be earning gains. Over time, these gains and losses may cause your asset allocation to skew away from your target mix.2 Or your tolerance for risk may evolve over time. Lifestyle changes can also necessitate a readjustment to your allocation. That’s why it’s important to monitor your mix and make adjustments when necessary.

Step 3: Increase your savings rate.

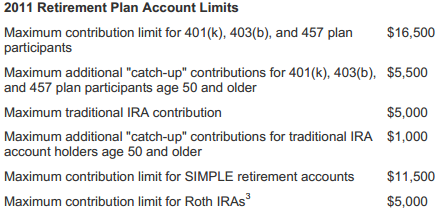

Perhaps the most important way to help fund your future is to sock away as much as possible. Finding the extra money to invest can be tough — you’ve got plenty of expenses to worry about today without the added anxiety of worrying about tomorrow. But every dollar you can spare can make a difference. Whether retirement is just around the corner or 30 to 40 years away, regularly setting money aside — particularly in a tax-deferred vehicle such as a 401(k) or tax-exempt account like a Roth IRA — can often be the smartest move you can make.

Source/Disclaimer

1 Source: Employee Benefit Research Institute, EBRI Notes, October 2010.

2 Diversification and asset allocation do not ensure a profit or protect against a loss in a declining market.

3 Roth IRA contributions may be made only by single taxpayers with modified adjusted gross incomes (MAGIs) of less than $122,000 and married joint filers with MAGIs of under $179,000. Phase-out limits for partial contributions also apply. If your MAGI is close to or over these limits, talk to your financial or tax professional before contributing to a Roth IRA.

January 2011 — This column is provided through the Financial Planning Association, the membership organization for the financial planning community, and is brought to you by Capital Strategies, Inc., a local member of FPA.

Required Attribution

Because of the possibility of human or mechanical error by McGraw-Hill Financial Communications or its sources, neither McGraw-Hill Financial Communications nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall McGraw-Hill Financial Communications be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2011 McGraw-Hill Financial Communications. All rights reserved.